Dollar bulls and bears were both restrained this week with prices stuck in a tight range as investor anxiety mounts ahead of Friday’s heavily anticipated Jackson Hole gathering. This event has seized center stage with markets most likely searching for key hints on US rate hike timings which could dispel the period of uncertainty. There may be a possibility of Yellen addressing the inflation dilemma in the States while also keeping the doors open for a live meeting in September to raise US rates. Although anxiety continues to cloud the markets, optimism over the Fed taking action has already been bolstered this week following hawkish comments by other Fed members and strong US housing data which eased concerns over the US economy. Some attention may be directed towards Thursday’s Core durable goods orders report which if exceeds expectations may compound to the attributes that provide a firm case for the Fed to raise rates in December.

The Dollar Index has oscillated between losses and gains this week but still remains bearish on the daily timeframe. Prices are trading below the daily 20 SMA while the MACD has crossed to the downside. Previous support around 95.00 could transform into a dynamic resistance that opens a path towards 94.00.

Oversupply fears entice WTI bears

WTI Crude experienced a sharp decline on Wednesday with prices sinking towards $46.50 following the unexpected increase in US crude stocks that rekindled concerns over the excessive oversupply in the global markets. Crude oil stockpiles have been incessantly rising while rig counts have risen for eight consecutive weeks reinforcing the fundamentals of an excessive oversupply. For an extended period, oil simply ignored the bearish fundamentals as the inflated expectations over OPEC securing a freeze deal propelled prices to shocking levels. While OPEC members may be commended on their ability in exploiting the oil price sensitivity to create speculative boosts in oil prices, this will come at a heavy cost.

The cartel’s credibility balances on a thin line and if September’s informal meeting follows the same fashion as Doha’s meeting, then not only will the credibility be tarnished further but oil could be left vulnerable to extreme losses. It should be kept in mind that OPEC faces an obvious prisoner’s dilemma from cutting production as such could provide an incentive for US shale to jump back into the markets.

WTI bears have emerged and the fears of Chinese crude demand diminishing as Beijing investigates alleged tax evasions in the oil industry may keep prices depressed. Bears could reclaim control with the horrible combination of oversupply fears and concerns that demand may be faltering encouraging sellers to install repeated rounds of selling on oil. From a technical standpoint, a breakdown below $46 could open a path towards $44.

GBPUSD elevated by Dollar vulnerability

Sterling was resilient against the Dollar this week and this has nothing to with an improved sentiment towards the Sterling but Dollar weakness from fluctuating US rate hike expectation. Although economic data from the UK economy has displayed signs of stability consequently questioning if the Brexit had any negative impact, it remains quite early to come to a conclusion with more time needed to truly size up the Brexit effect. Sterling still remains the worst performer among major currencies since the referendum with further declines expected if expectations heighten over the Bank of England implementing further stimulus measures. Investors may direct their attention towards the second quarter GDP report released on Friday which could offer clarity on how the UK economy has fared in a period of global uncertainty. A disappointing GDP figure may renew speculations over the BoE cutting UK interest rates to near zero before year end.

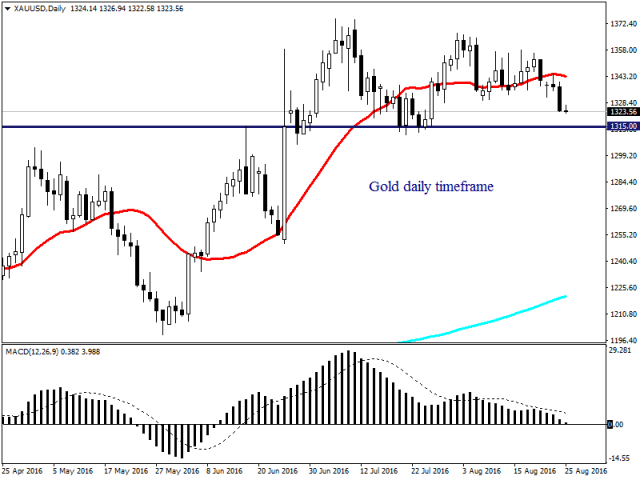

Commodity spotlight – Gold

Gold abruptly fell to four-week lows around $1325 on Wednesday as the persistent uncertainty over the Fed raising US rates in 2016 encouraged anxious investors to relinquish their bullish bets. This precious metal remains highly sensitive to US rate hike expectations with explosive movements expected on Friday if Yellen provides investors the clarity they have long sought. If Hawks come out to play on Friday then Gold bears could be installed with enough inspiration to break below the stubborn $1315 support. On the other hand, if investors are left empty handed and fail to retrieve any direction on when US rates will be increased then Gold could lurch higher. From a technical standpoint, bulls need to keep above $1315 to validate the current bullish uptrend.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.